georgia ad valorem tax trade in

Each vehicle you register in Georgia is subject to either one of the tax systems. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to.

In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for.

. TAVT rates are set by the Georgia Department of Revenue. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Dealerships will be required to collect the TAVT on behalf of the customer and.

As an example if the fair market value of a used vehicle in Georgia is 14000 the TAVT that the owner of the automobile is required to pay. Will the title ad valorem tax always be set at 65. Everyone who owns a vehicle licensed in Georgia must pay ad valorem tax at the time of purchase.

Instead the purchased vehicles are subject to the new one-time TAVT. How can I avoid paying the car sales tax in Georgia. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Use Ad Valorem Tax Calculator. Under this system owners of all vehicles purchased before March 2013 pay an annual ad valorem tax when renewing their. What if I think that the title ad valorem tax assigned to my vehicle is too high.

Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie. Tax title and tag fees that are charged when purchasing a vehicle in Georgia are as follows. Per the Georgia Department of Revenue Only the ad valorem tax portion of the annual auto registration can.

Cars Purchased On or After March 1 2013. Trade-ins reduce the sales tax that you would pay on a vehicle. Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value shown by the NADA.

This tax is based on the value of the vehicle. Does a trade-in reduce sales tax in Georgia. Buyers must pay this Title Fee on all vehicle sales including private sales and the Title Fee applies to all vehicles.

Georgia has two motor vehicle property types of taxes. Vehicles subject to TAVT are exempt from sales tax. The trade-in value of another motor vehicle will be deducted from the value to get the taxable value.

TAVT rates are set by the Georgia Department of Revenue. This calculator can estimate the tax due when you buy a vehicle. If you are a new resident then you do not have to pay.

If an owner believes the value is too high for the condition of their vehicle they may appeal the value to the County Board of Tax Assessors. Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value shown by the NADA. Vehicles subject to TAVT are exempt from sales tax.

For tax year 2018 Georgias TAVT rate is 7 prtvrny. Title Ad Valorem Tax TAVT and Annual Ad Valorem Tax. Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia.

Currently the ad valorem tax formula that applies to your vehicle depends on whether you purchased the vehicle before March 1 2013 or after. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from the sales and use tax and the annual ad valorem tax. Georgia is exempt from sales and use tax and the annual ad valorem tax also known as the birthday tax These taxes are replaced by a one-time tax called the title ad valorem tax fee TAVT.

Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT. Ad Get Access to the Largest Online Library of Legal Forms for Any State. If I itemize deductions on Federal Schedule A can I deduct my auto registration and ad valorem tax.

Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or birthday tax. For the answer to this question we consulted the Georgia Department of Revenue. For instance if you purchase a vehicle for 50000 and your trade-in is valued at 10000 then you are only taxed on the 40000 purchase price.

Beginning January 1 2014 the tax rate will increase to 675.

Bank Guarantee For Trade Finance Or For Import Amp Amp Export

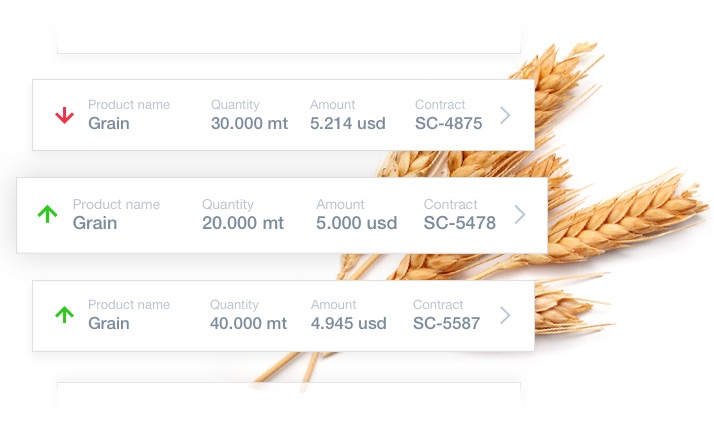

Commodity Erp Software Solutions For Your Commodity Trade Business

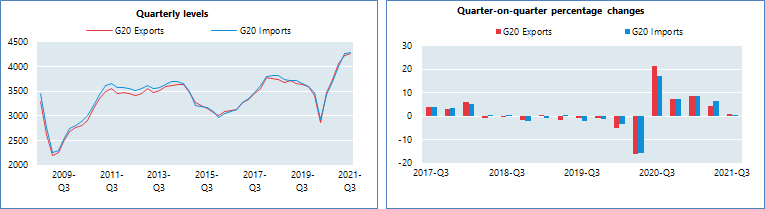

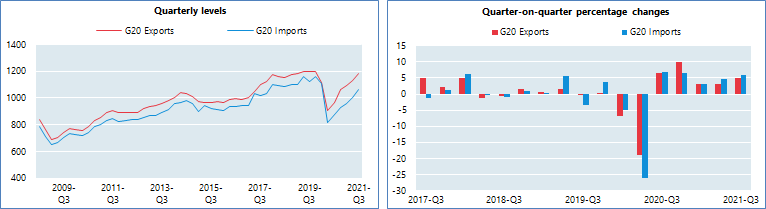

International Trade Statistics Trends In Third Quarter 2021 Oecd

International Trade Statistics Trends In Third Quarter 2021 Oecd

Commodity Erp Software Solutions For Your Commodity Trade Business

Resistance Is Not Futile Solaria Powerxt Panels Now Classified As Pid Resistant Solar Builder Lắp đ Solar Panels For Home Solar Solutions Solar Installation

Bti 2022 Georgia Country Report Bti 2022

Infographic Which Countries Are Open For Business Business Regulations Business Infographic

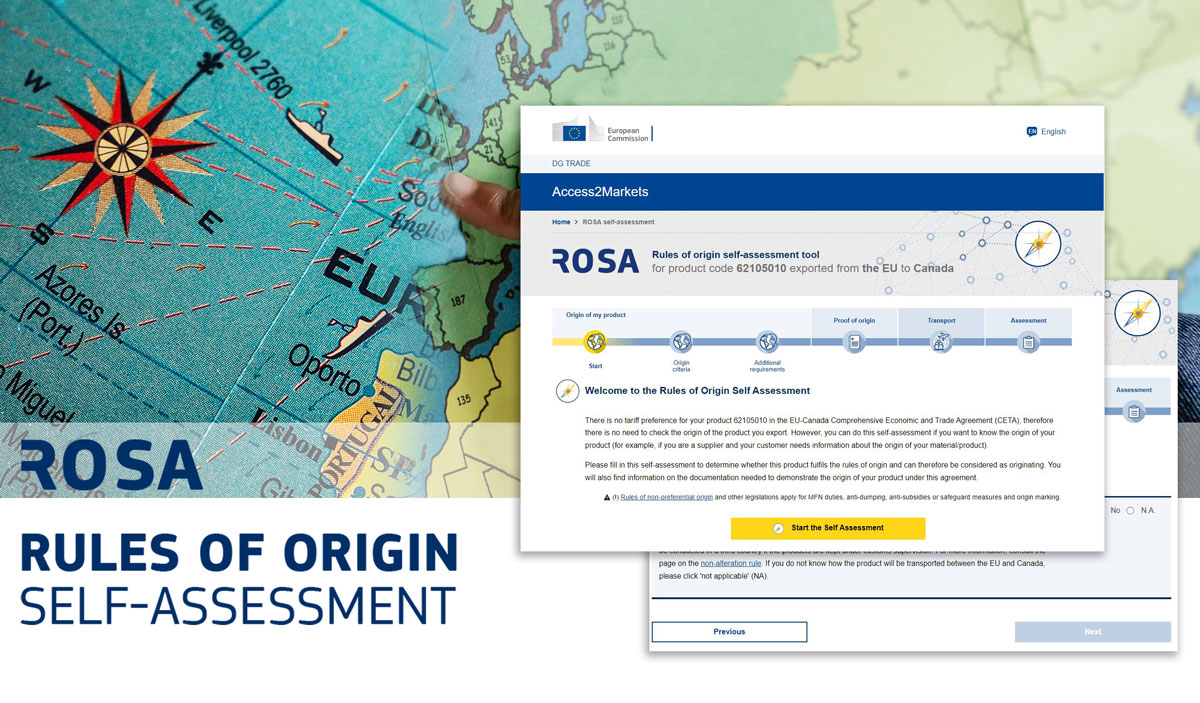

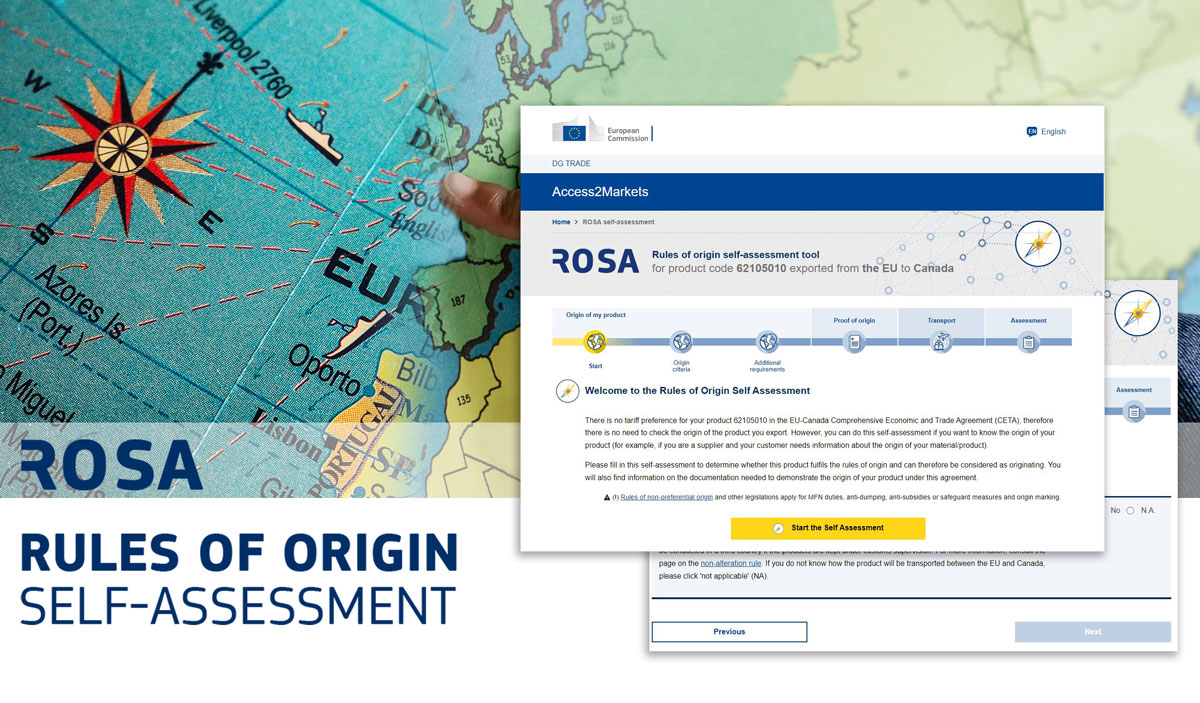

Access2markets Presenting Rosa

Salud How To Read A Wine Label Here Are Some Abcs In Decoding Them Ava Usa Aoc France Do Spai Landscape Maintenance Healthy Garden Santa Fe Home

Documents You Should Have While Applying For Business Loan

State By State Guide To Taxes On Retirees Inheritance Tax Estate Tax Purple States

The Town Of Loudwater In The Forgotten Realms

Infographic Which Countries Are Open For Business Business Regulations Business Infographic